- Sharing Office Space Rental Agreement Template

- Rental Agreement For Shared Space

- Office Space Sharing Agreement Template Download

EXHIBIT 10.10

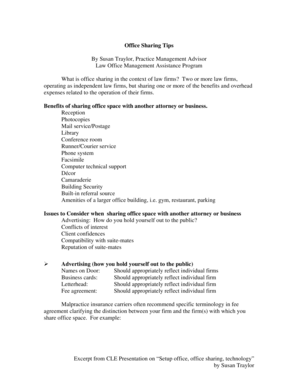

Under this Agreement is for the rental of the Designated Office and for the general use of common areas permitted by the Sublessee, and for other service that may be obtained from the Sublessee at an additional cost. USE The use of the Designated Office shall be limited to use by the User to not more than two people, in number, at any given. Always put your agreement in writing when sharing office space with another small business. To get started, use this sample office sharing agreement as a model in preparing your own. This one is for a group of compatible professionals—a few lawyers, a financial planner, and a website developer—but you can adapt it to your own situation.

One cost-effective alternative to traditional office leasing is sharing office space. An office space can be a large overhead expense and a cash drain on precious capital. Shared office space, also known as serviced office space, business centers, or executive suites are a turn-key office solution providing an office space shared by other. Office space lease contract is a very important contract agreement in the business which can be written down between two parties. As a tenant, such kind of agreement lets you know about the deal and you can easily guess whether you have been treated fairly in the contract or not. Office Space Lease Agreement Template. File Size: 56 KB. Space Sharing Agreement. Landlord and Tenant each hereby release, acquit and forever discharge, as of the Recapture Date, the other and the other’s officers, directors, trustees, agents, representatives, employees, successors, affiliates, and assigns (collectively, “Agents”) from any and all claims, demands, debts, charges, complaints, liabilities, causes of action, damages,.

This Resource Sharing Agreement (the “Agreement”) ismade as of January 29, 2009 (the “Effective Date”), by and between salesforce.com, inc. (“SFDC”), a Delaware corporation, having its principal place of business at The Landmark @ One Market, Suite 300, SanFrancisco, California 94105, salesforce.com foundation (the “Foundation”), a California nonprofit public benefit corporation, having its principal place of business at The Landmark @ One Market, Suite 300, San Francisco, California94105, and salesforce.org (the “Enterprise”), a California nonprofit public benefit corporation, having its principal place of business at The Landmark @ One Market, Suite 300, San Francisco, California 94105 (each individually, a“Party,” and collectively, the “Parties”).

RECITALS

| A. | The Foundation is a non-profit entity, exempt from income tax under Internal Revenue Code §501(c)(3) and corresponding provisions of state law, and is classified as a publiccharity under Internal Revenue Code §509(a)(1). |

| B. | The Enterprise is a non-profit entity, exempt from income tax under Internal Revenue Code §501(c)(4) and corresponding provisions of state law. |

| C. | SFDC, and its employees, are the primary contributor to the Foundation. SFDC provides certain office space, furniture, equipment, facilities, services and other resources(collectively, the “Resources”) to the Foundation. |

| D. | SFDC is the primary contributor to the Enterprise through the Reseller Agreement of even date herewith between SFDC and the Enterprise. SFDC also provides Resources to theEnterprise. |

| E. | The Foundation and the Enterprise expect to share Resources in the course of their activities. |

| F. | The Parties desire to enter into a contractual relationship regarding their relationship, including their sharing of the Resources within the United States, it being understood thatthe Parties or their affiliates have entered or will enter into separate contractual relationships regarding their respective relationships, including their sharing of resources, in other countries and/or regions. |

Sharing Office Space Rental Agreement Template

NOW, THEREFORE, the Parties agree as follows:1.Employees. To the extent feasible, each Party shall hire, compensate, supervise, discipline, and discharge its own full-time and part-time employees, who shall be under the sole control and ultimate supervision of its own board of directors.Part-time employees of any Party may also be part-time employees of another Party. Full-time employees of SFDC may from time to time perform services for the Foundation or the Enterprise. Neither the Foundation nor the Enterprise shall be requiredto reimburse SFDC for such services.

2. Office Space. SFDC leases office space at The Landmark @ One Market, San Francisco, California 94105 (the“Premises”), portions of which SFDC has assigned, and shall continue to assign, to the Foundation and the Enterprise for their direct use (the “Dedicated Space”). In addition to their use of the Dedicated Space, theFoundation and the Enterprise also make use of a proportionate share of common space within the Premises (the “Shared Common Space”). However, for tax and accounting purposes, the fair share of the rent specified in SFDC’slease agreement for use of the Premises by the Foundation and the Enterprise shall be calculated, from time to time, at SFDC’s discretion, by multiplying SFDC’s total rental obligation by a fraction whose numerator is the number ofFoundation and Enterprise personnel generally making use of the Premises and whose denominator is the total number of SFDC, Foundation, and Enterprise personnel generally making use of the Premises (such ratio to be referred to as the“Foundation and Enterprise Ratio”).

3. Utilities, Insurance and Similar Items of Facility Overhead. Neither the Foundation nor theEnterprise shall be required to reimburse SFDC for their share of SFDC’s utilities, insurance and similar items of facility overhead arising from the use of the Premises by the Foundation and the Enterprise. However, for tax and accountingpurposes, the fair share of such utilities, insurance, and other items of overhead shall be calculated, from time to time and at SFDC’s discretion, by multiplying the total cost to SFDC of such items by the Foundation and Enterprise Ratio.

4. Furniture and Equipment. Neither the Foundation nor the Enterprise shall be required to reimburse SFDC for use of office furniture and equipment(including chairs, desks, phones, computers, printers, fax machines, copiers, and the like) in connection with their use of the Premises. However, for tax and accounting purposes, the fair share of expenses relating to such use shall be calculated,from time to time and at SFDC’s discretion, by multiplying the total cost to SFDC of use of such items by the Foundation and Enterprise Ratio. To the extent possible, the Foundation and the Enterprise shall each use their own fax machines andcolor printers.

5. Software. Neither the Foundation nor the Enterprise shall be required to reimburse SFDC for use of basic office productivitysoftware (including Microsoft Office and Microsoft Outlook) licensed to SFDC. However, for tax and accounting purposes, the fair share of expenses related to the use of such software by the Foundation and the Enterprise shall be calculated, fromtime to time and at SFDC’s discretion, by multiplying the total cost to SFDC of use of such software by the Foundation and Enterprise Ratio. The Foundation and the Enterprise shall each be responsible for purchasing and maintaining anyadditional software they may need, including graphics and layout programs such as Adobe PhotoShop.

6. Internal Business Applications. Neither theFoundation nor the Enterprise shall be required to reimburse SFDC for use of business applications used by SFDC internally (including the 62 org, the Intranet and Workday). However, for tax and accounting purposes, the fair share of expenses relatedto the use of such business applications by the Foundation and the Enterprise shall be calculated, from time to time and at SFDC’s discretion, by multiplying the total cost to SFDC of use of such business applications by the Foundation andEnterprise Ratio. The Foundation and the Enterprise shall each be responsible for implementing and maintaining their own billing and collection systems.

2

7. Supplies and Miscellaneous Goods and Services. Neither the Foundation nor the Enterprise shall be required toreimburse SFDC for normal use of office supplies or other miscellaneous consumable goods and services, including supplies and expenses relating to incidental printing and mailing. The Foundation and the Enterprise shall each bear their own expensesfor creating and distributing specialized marketing materials, mass mailings, and messenger and express delivery services.

8. Travel andTransportation. Each Party shall separately bear its own travel and transportation expenses. Expenses relating to travel or transportation by employees, contractors, or volunteers where work is performed on behalf of both parties shall beallocated to each Party in proportion to the hours of work performed on the trip by the traveler, for that Party, as compared to the total number of hours of work performed on the trip by the traveler.

9. Telecommunications. Neither the Foundation nor the Enterprise shall be required to reimburse SFDC for use of network and telecommunications equipment andfacilities licensed or owned by SFDC, including networking equipment, software, bandwidth, ISP and hosting services, and the like. However, for tax and accounting purposes, the fair share of expenses relating to the use of such equipment andfacilities by the Foundation and the Enterprise shall be calculated, from time to time and at SFDC’s discretion, by multiplying the total cost to SFDC of use of such equipment and facilities by the Foundation and Enterprise Ratio.10. Tracking, Billing and Payment. SFDC shall be responsible for tracking, calculating, allocating, and billing any amounts that may be charged to theFoundation or the Enterprise under this Agreement.

11. Term and Termination. This Agreement shall continue until terminated by either party withthirty (30) days prior written notice.

12. Confidentiality.

3

(b) Protection of Confidential Information. Except as otherwise permitted in writing by the DisclosingParty, (i) the Receiving Party shall use the same degree of care that it uses to protect the confidentiality of its own confidential information of like kind (but in no event less than reasonable care) not to disclose or use any ConfidentialInformation of the Disclosing Party for any purpose outside the scope of this Agreement, and (ii) the Receiving Party shall limit access to Confidential Information of the Disclosing Party to those of its employees, contractors and agents whoneed such access for purposes consistent with this Agreement and who have signed confidentiality agreements with the Receiving Party containing protections no less stringent than those herein.

(c) Protection of Customer and Employee Data. Without limiting the above, each party shall maintain appropriate administrative, physical, and technicalsafeguards for protection of the security, confidentiality and integrity of Customer and Employee Data.(d) Compelled Disclosure. TheReceiving Party may disclose Confidential Information of the Disclosing Party if it is compelled by law to do so, provided the Receiving Party gives the Disclosing Party prior notice of such compelled disclosure (to the extent legally permitted) andreasonable assistance, at the Disclosing Party’s cost, if the Disclosing Party wishes to contest the disclosure. If the Receiving Party is compelled by law to disclose the Disclosing Party’s Confidential Information as part of a civilproceeding to which the Disclosing Party is a party, and the Disclosing Party is not contesting the disclosure, the Disclosing Party will reimburse the Receiving Party for its reasonable cost of compiling and providing secure access to suchConfidential Information.

13. General.

(a) Governing Law. This Agreement shall be governed by the internal laws of the State of California.

(b) EntireAgreement. This Agreement represents the entire agreement of the parties with respect to its subject matter and supersedes any prior or contemporaneous agreements, proposals or representations, written or oral, concerning its subject matter.

Rental Agreement For Shared Space

4

IN WITNESS WHEREOF, the parties have executed this Agreement as of the Effective Date.

| SALESFORCE.COM, INC. | ||

| By: | /s/ David Schellhase | |

| Name: | David Schellhase | |

| Title: | SVP, General Counsel and Secretary | |

| SALESFORCE.COM/FOUNDATION | ||

| By: | /s/ Suzanne DiBianca | |

| Name: | Suzanne DiBianca | |

| Title: | Executive Director | |

| SALESFORCE.ORG | ||

| By: | /s/ Suzanne DiBianca | |

| Name: | Suzanne DiBianca | |

| Title: | President | |

5

Office space lease agreement is required to be written when you have found an office for running your business. It is very important to draw the office space lease contract in a well way so that the smooth relationship between the tenant and the landlord can be developed.

You can design this office space lease contract when you are going to give your own property on rent to someone or you going to give your commercial property on lease. You can also use this contract when you want to lease the commercial rental property from that landlord who does not possess any lease form.

Office Space Sharing Agreement Template Download

As a landlord, this contract ensures the person that his property is going in safe hands and that he will get his property back when the agreement will end. All the basics of the contract such as the amount of rent, the length of the lease agreement etc will be added in the agreement. Some important conditions are also important to be nailed down in the agreement such as how the tenant will be using the office and for what purpose he can use and what are the purposes which are prohibited in that office.

Office space lease contract is a very important contract agreement in the business which can be written down between two parties. As a tenant, such kind of agreement lets you know about the deal and you can easily guess whether you have been treated fairly in the contract or not.

Preview

Office Space Lease Agreement Template

File Size: 56 KB

DownloadWord (.doc) 2003+